Comprehensive, Frictionless Access for Institutions

Prime brokerage enabling institutions to scale

faster and enhance profitability through direct

market access and a global agency trading desk.

FPG’s customers manage over $50B.

Top-performing

Hedge Funds

Traders running algorithmic

investment strategies

Venture

Capitalists

Funds targeting crypto and

web3 startups

Foundations and Charities

Top projects managing

$1B+ endowments

About FlowVaultLearn More

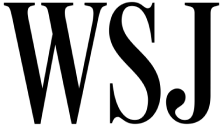

Platform for Centralized and

Decentralized Crypto Access

01. Lower Trading Fees

Benefit from FPG’s scale and access better fee tiers on each exchange where you trade.

02. Onboard Once

03. User Roles & Approvals

04. Transfers Portal & API

05. Access DeFi Opportunities

Trade With UsLearn More

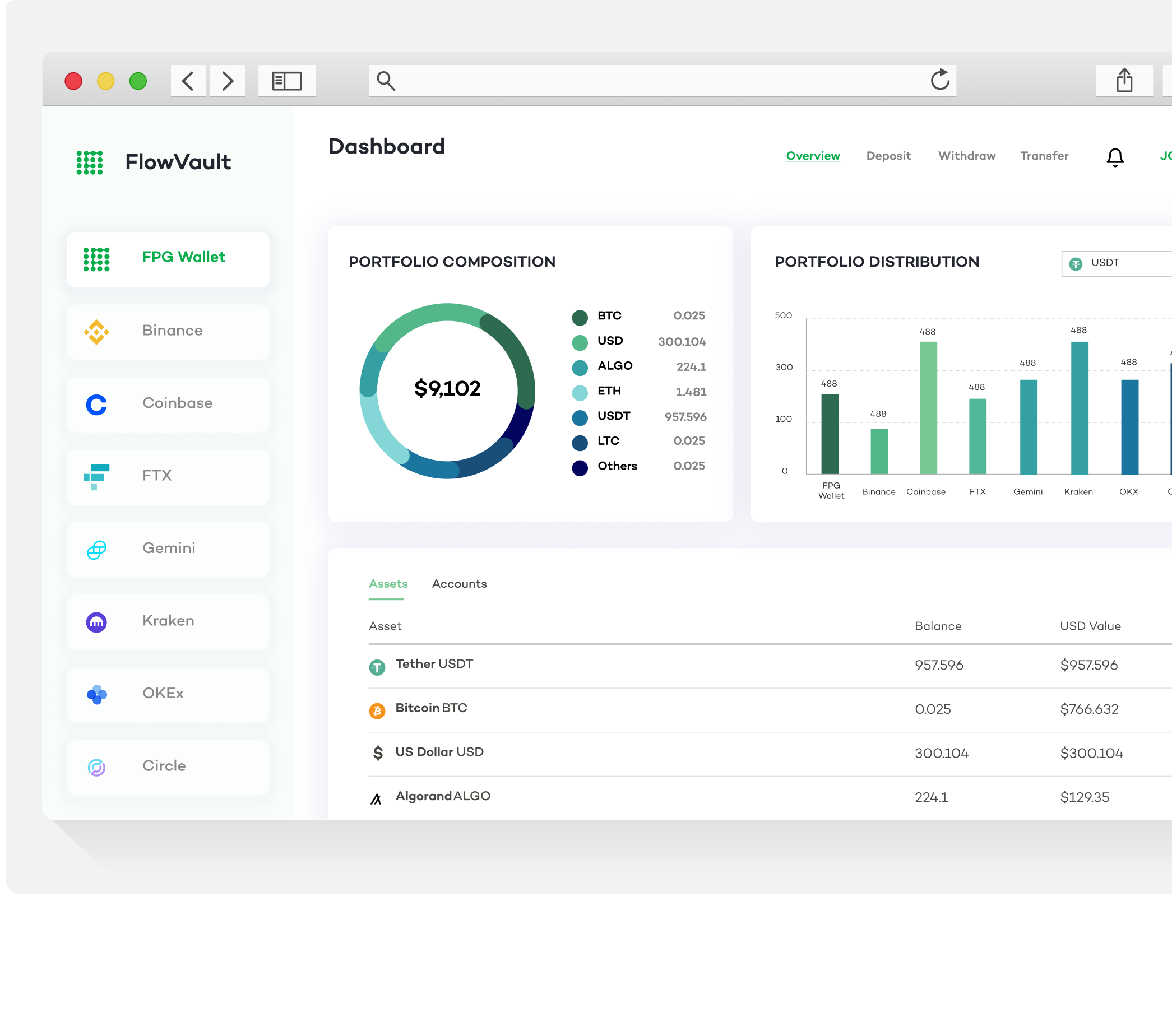

Beat Slippage and Fund Your Business Without Moving the Market

01. Your Agency Trading Team

We trade with you, not against you, to beat your target price on every order.

02. Less Slippage

03. Always-On Trading Team

04. Customizable Order Structure

05. Privacy and Anonymity

Press

InsightsView All Blogs

Webinars & Podcasts

Nov 30, 2022

“FTX Was a Bucket Shop All Along” by Blockworks’ Jack Farley featuring FPG cofounder Kevin March

October 30, 2022

Coindesk TV: Dogecoin futures rack up nearly $90 million in liquidations with expert John Peurifoy, CEO of Floating Point Group

FPG is a prime brokerage enabling institutions to scale

faster and enhance profitability through market

access and a global agency trading desk.